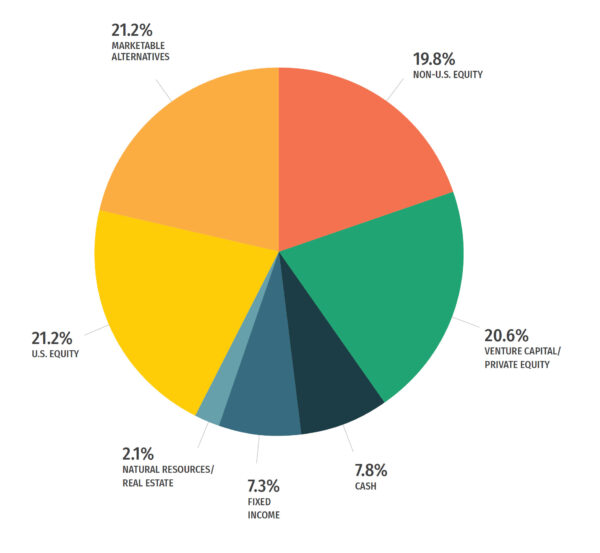

A Diversified Portfolio

The goal of the Maine Community Foundation’s investment program is to preserve and enhance the real value of assets over time.

The goal of the Maine Community Foundation’s investment program is to preserve and enhance the real value of assets over time.

To accomplish this goal, the community foundation employs a globally diversified asset allocation and utilizes more than 30 different investment managers. Additional financial and investment information is available at mainecf.org/investments.

Investment Performance

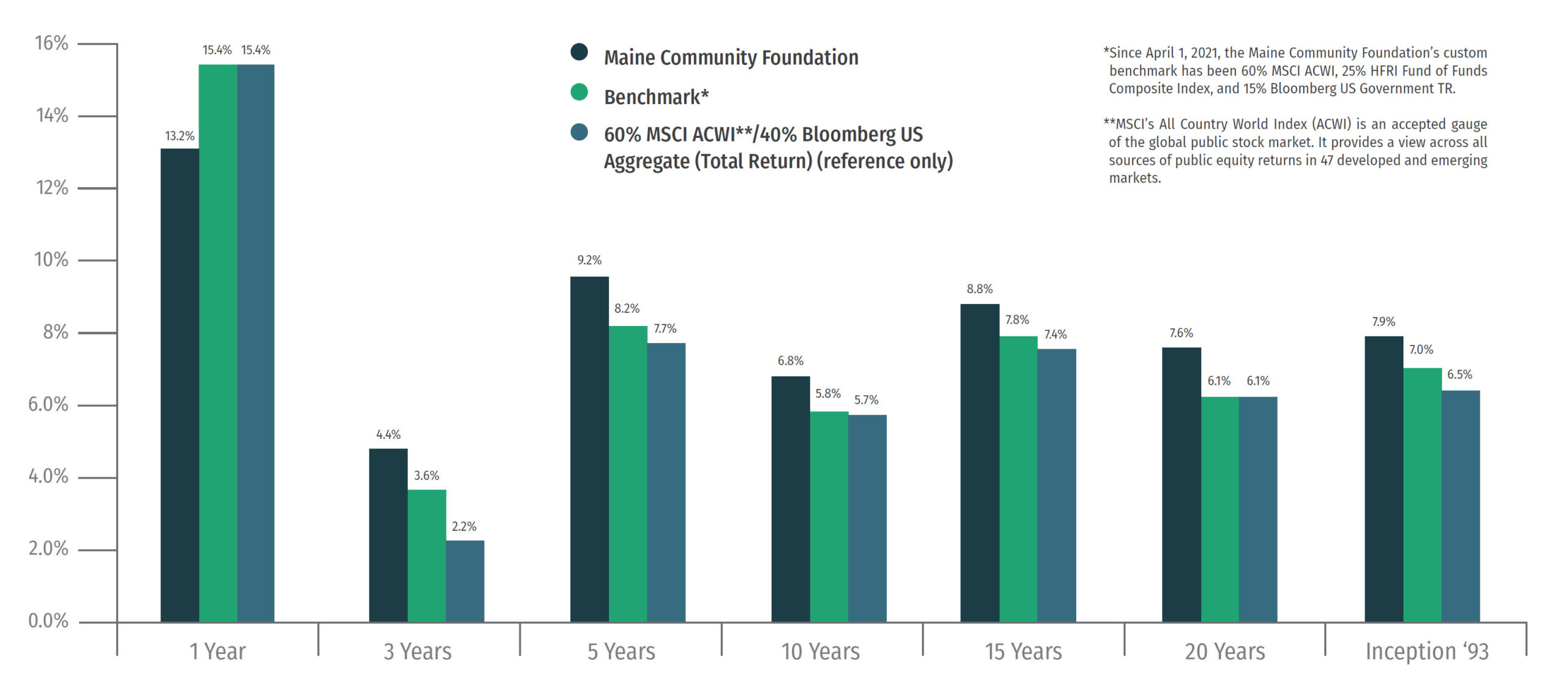

Effective stewardship of philanthropic assets is the key to building permanent charitable funds that can help strengthen Maine communities. MaineCF has maintained a sound record of risk-adjusted returns that has served the foundation and its donors well over the long term.

2023 saw a rebound from the historically difficult 2022, as the “Magnificent Seven” drove the S&P500 higher. In this environment, the primary pool portfolio returned 13.2% compared to our benchmark’s return of 15.4% for 2023.

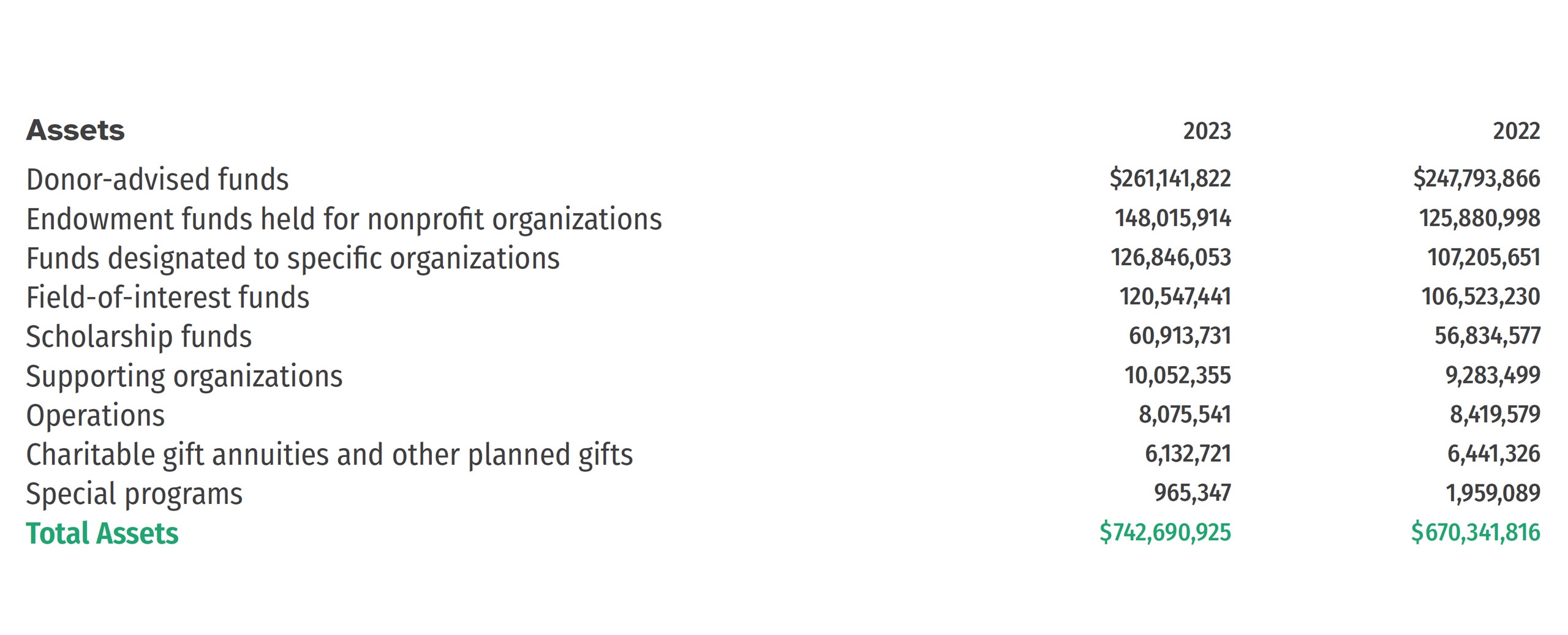

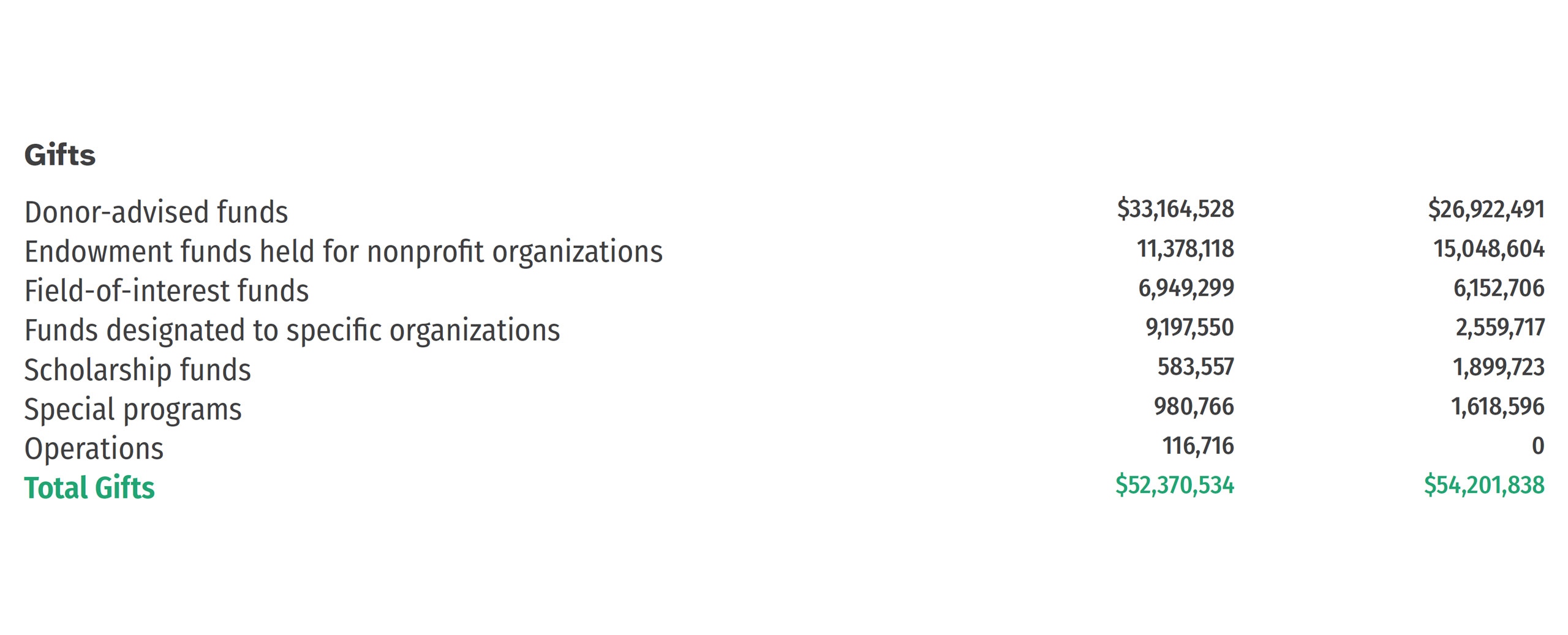

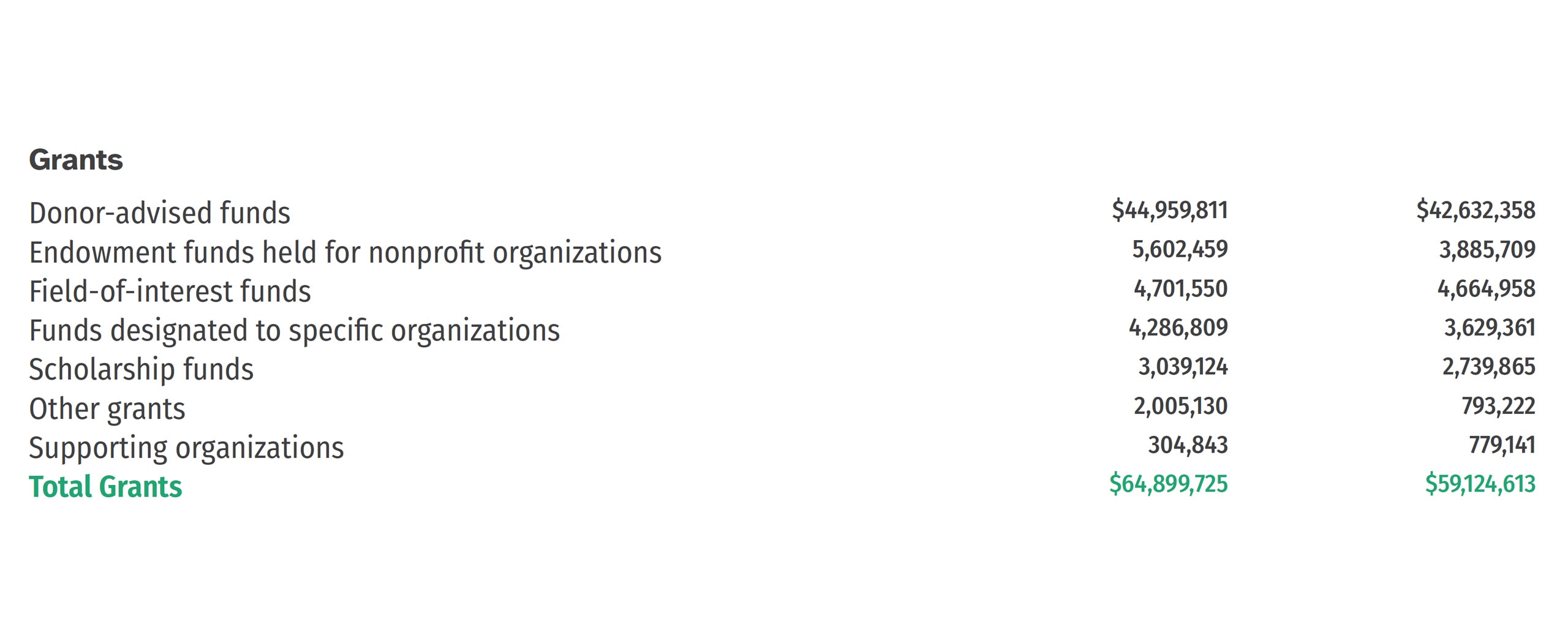

Financial Summary

From inception through 2023, MaineCF’s primary investment portfolio has gained an annualized 7.9 percent while our benchmark index for the same period is 7.0 percent. Our overall strategy remains the same: to balance risk in order to preserve and grow capital for charitable purposes. The following chart provides financial figures as of Dec. 31, 2023, with comparative information for the preceding year.

Responsible Investing

MaineCF is committed to ensuring that Maine is a safe, welcoming, and accepting place for everyone. This commitment extends to management of the community foundation’s investment assets through work with investment managers who demonstrate a shared commitment to environmental, social, governance, diversity, equity, and inclusivity (ESG and DEI) factors.

Building Investments in Maine

For more information on MaineCF’s investment policies, please contact Brendon Reay, vice president of investments and chief investment officer, breay@mainecf.org. For a copy of the 2023 audited financial statements, please contact Elena Sulima, director of finance, esulima@mainecf.org. You can also visit mainecf.org to view audited financial statements, tax returns and to learn more about the foundation’s investment program.

2% in Maine

Beginning in 2023, MaineCF committed 2% of the primary investment portfolio to investments right here in the state of Maine. Of that ~$14M amount, $8.1M has been committed or invested.

Strengthening Operations and Security

MaineCF’s strategic plan identified the need for the foundation to strengthen operations so that all departments and technologies run smoothly in order to build a better Maine.

To that end, a core team comprising staff from each department joined together two years ago to select and implement a new customer relationship management platform. After many hours of research and discovery, MaineCF selected Salesforce to replace several different platforms the foundation previously used. Staff began using Salesforce in the spring.

The integration of Salesforce will improve operations and allow staff to manage fundholder, grantee and other relationships more effectively. A single access point to a cloud-based system will also improve security.

Fundholders will enjoy more streamlined communications, more features on the fundholder portal and a broader and more detailed view of their relationship with MaineCF.

Reach out to your staff contact for questions about the new fundholder portal or call 207-667-9735.